Total View

AMERIPRISE

Opportunity

Create an improved online account aggregation tool that give advisors and clients a comprehensive view of their accounts held at Ameriprise Financial and more than 10,000 other U.S.-based financial institutions. The tool can be accessed by clients here on the Ameriprise secure site and advisors can access it on advisor portal.

Hypothesis

An improved interface and easier account addition pathways, would make a more robust, usable and useful client dashboard of all their accounts. Customers would be more likely to integrate other accounts if the interface was easy to use and maintain.

Goal

Upgrade UX and uplift UI experience for an existing system to make easier to use and lessen error issues by moving away from current data aggregator partner and using API’s to better control and improve our customer experience .

Roles

define strategy, architecture, and implementation of design patterns

new patterns development

application and improvement of existing design system patterns

guide development team through application of strategy and design

coordinate with business partners on backend systems and limitations

collaborate with engineers and systems designers to ensure new patterns would work well and be properly adopted into design library

Research

Much of initial discovery and some of the patterns had been developed before I took the position, but needed to be completed and refined as I came into the role. As new issues and needs were defined, there was a need to develop changes to the UI, so there was additional testing done on various new patterns before and after releasing Phases of the upgraded site.

Pre-2020 Total View Dashboard

Usability Lab

Phases

Interview many teams within the technology umbrella to better understand what metrics they use, and how they use them. Initially the scope centered mostly around Engineering managers, but then the ask grew larger and the scope change with the input of executives. They also wanted metrics on the teams, but with additional information to help them understand context. The ask changed from being focused on managers to also including executive management.

Phases of dashboard upgrade

Additional testing

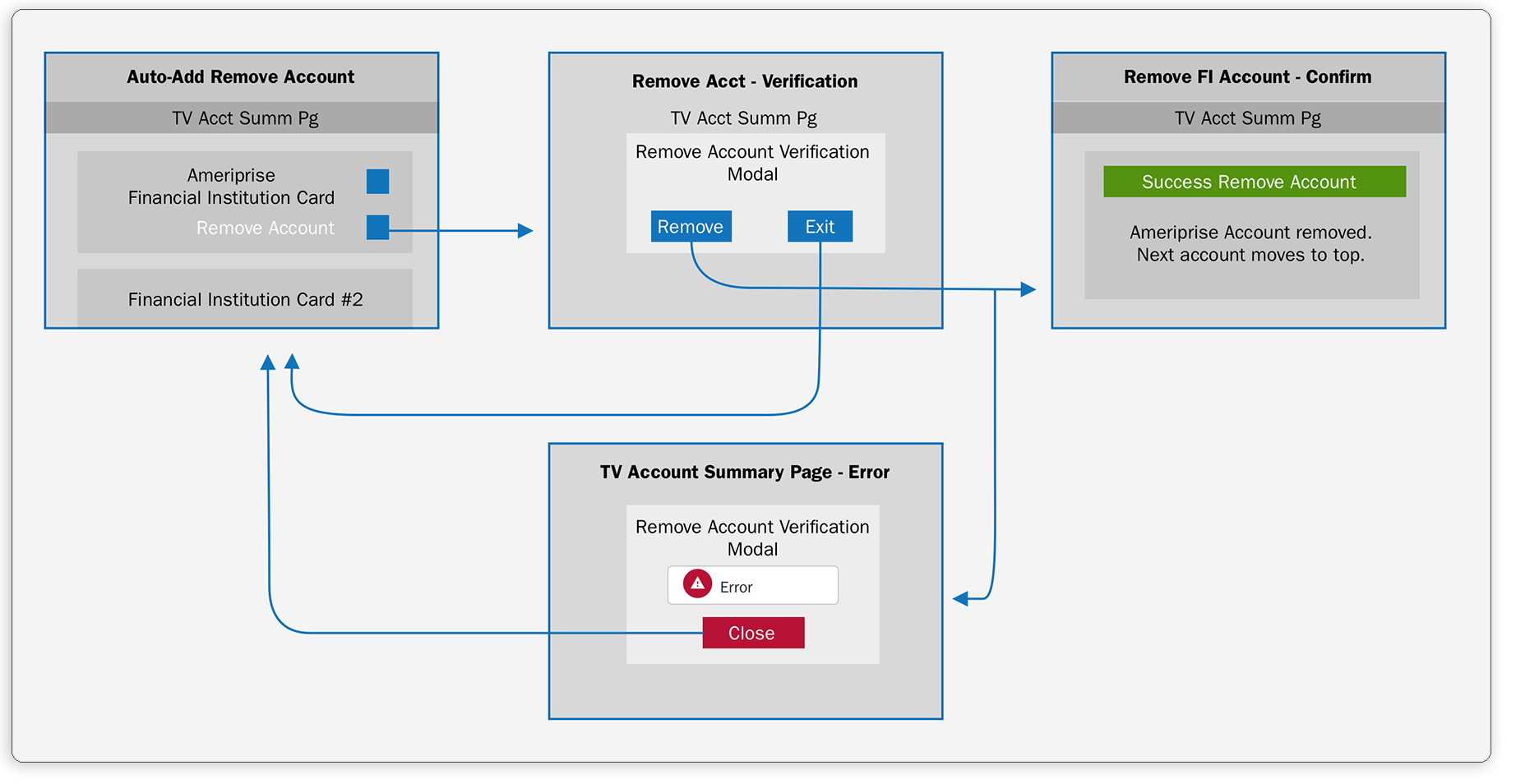

With more customer research and feedback we found that people preferred to manage their Total View accounts within the card, instead of going to a separate edit accounts page. Initially you could only remove and add accounts from an institution within a separate Add Accounts page.

Additional pattern testing

Challenges

The primary challenge was backend technologies that prevented, or adversely affected the ability and timeline to build a better customer experience. There were additional asks in during the planning phases (epics) of production. Various issues with outside vendor partners and backend systems, would often force adaptions to the interface, until they could be addressed.

Additional Ask

Ameriprise accounts owned by the account holder were not previously displayed as part of the Total View account page, which could show all the accounts a client may have in one place. After customer feedback, your personal Ameriprise accounts were added to see all financial at once.

Auto added Ameriprise Accounts to Total View dash

Outcome

After a successful upgrade, through several phases of development, roadblocks and new asks, agile methodologies were applied to integrate and test new changes. The end result was an easier to use and understand site where a client could see all of their investments in one place. This upgrade also let advisors help clients to better plan for the future.

Final designs